Mayo Report for 2019-11

|

|

Top Comics List Top Comics Breakdown Top Trades List Top Trades Breakdown

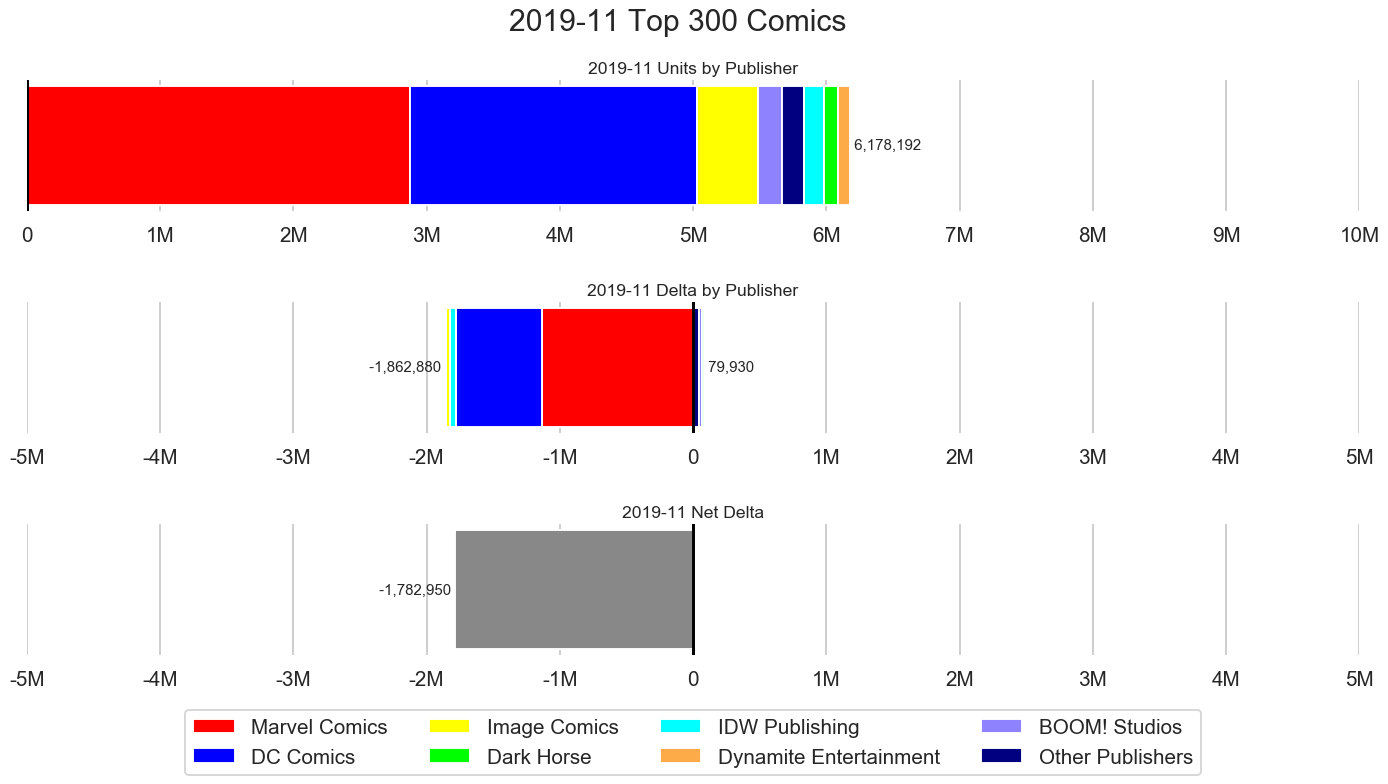

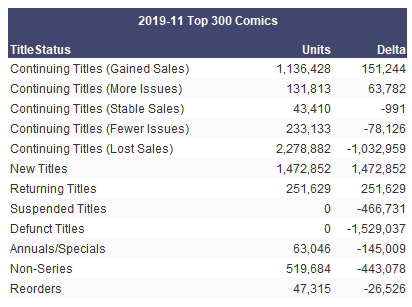

November 2019 had 6,178,192 units in the top 300 comics list, a decrease of 1,782,950 units from last month. This is the third largest drop for the top 300 comics. The only larger drops were the 1,819,545 unit drop in September 2016 and the 2,061,489 unit drop in January 2009.

Marvel Comics placed 2,877,935 units in the top 300 comics, a decrease of 1,131,970 units and accounted for 46.58% of the total units.

DC Comics placed 2,154,524 units in the top 300 comics, a decrease of 647,223 units and accounted for 34.87% of the total units.

Image Comics placed 454,103 units in the top 300 comics, a decrease of 27,653 units and accounted for 7.35% of the total units.

BOOM! Studios and Dark Horse were the only premiere publishers to increase in sales this month. BOOM! Studios was up 21,329 units to 177,938 units and Dark Horse was up 12,142 units to 103,684 units.

The premiere publishers accounted for 97.34% of the total units for the top 300 comics this month while all of the other publishers with items in the top 300 accounted for 2.66% of the total units for the top 300 comics.

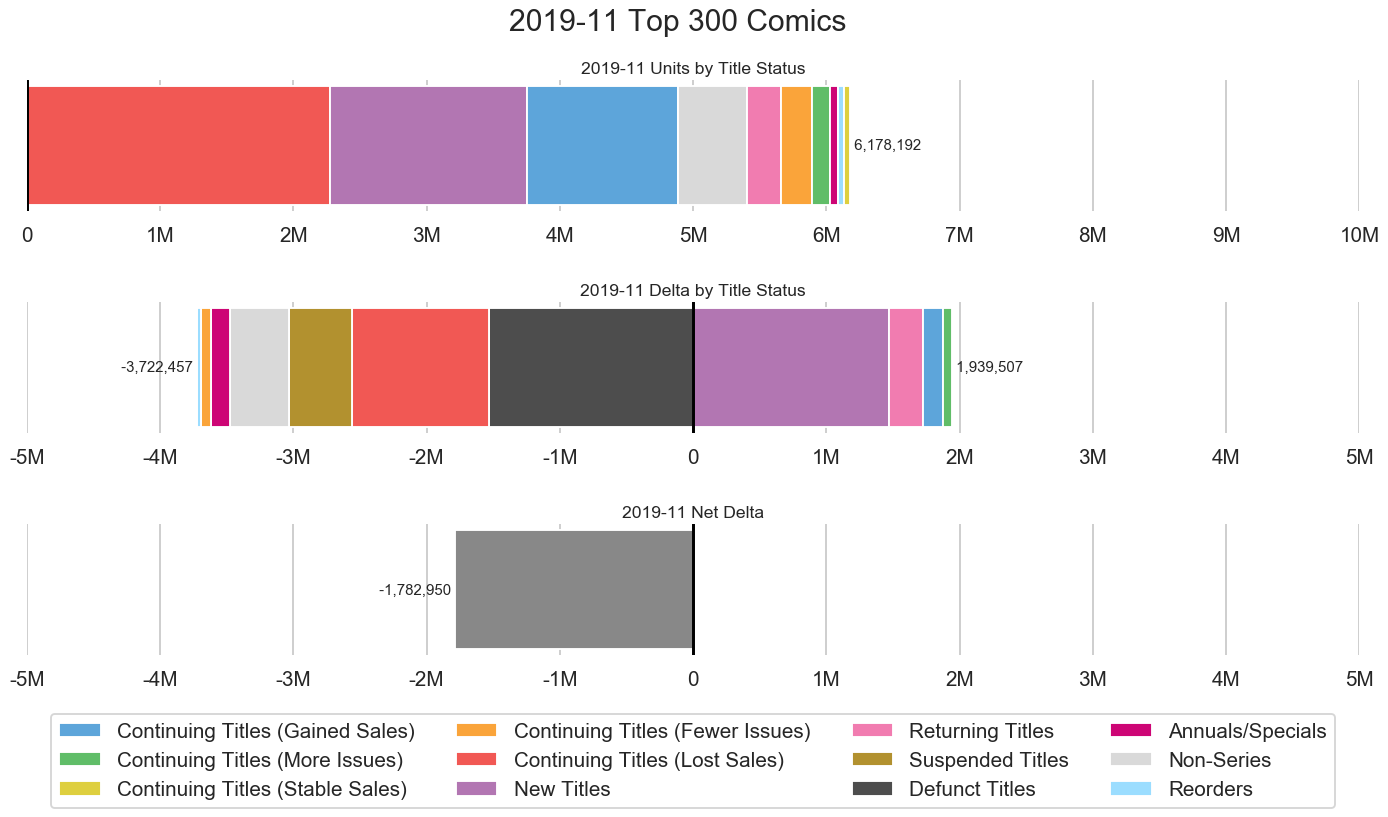

The up-swing of 1,939,507 units from new and increased sales was not enough to compensate for the down-swing of 3,722,457 units from lost sales for the net decrease of 1,782,950 units.

The total swing of 5,661,964 was nearly as much as the 6,178,192 units sold this month. If the inherent instability of the sales from month to month are not obvious from that fact alone, remember that sales would have been 1,782,950 units higher if the sales hadn't changed at all from last month. Further, note that sales would have been 3,722,457 units higher if the gain had happened and the losses hadn't. That optimistic outcome could have resulted in sales of 9,900,649 units which would have been a sales record over half million units higher than the highest the top 300 comics list has ever actually reached during the final order era.

The problem isn't that some titles end and new ones take their place on the list. The problem is the frequency with which that happens and the inherent sales instability created by it.

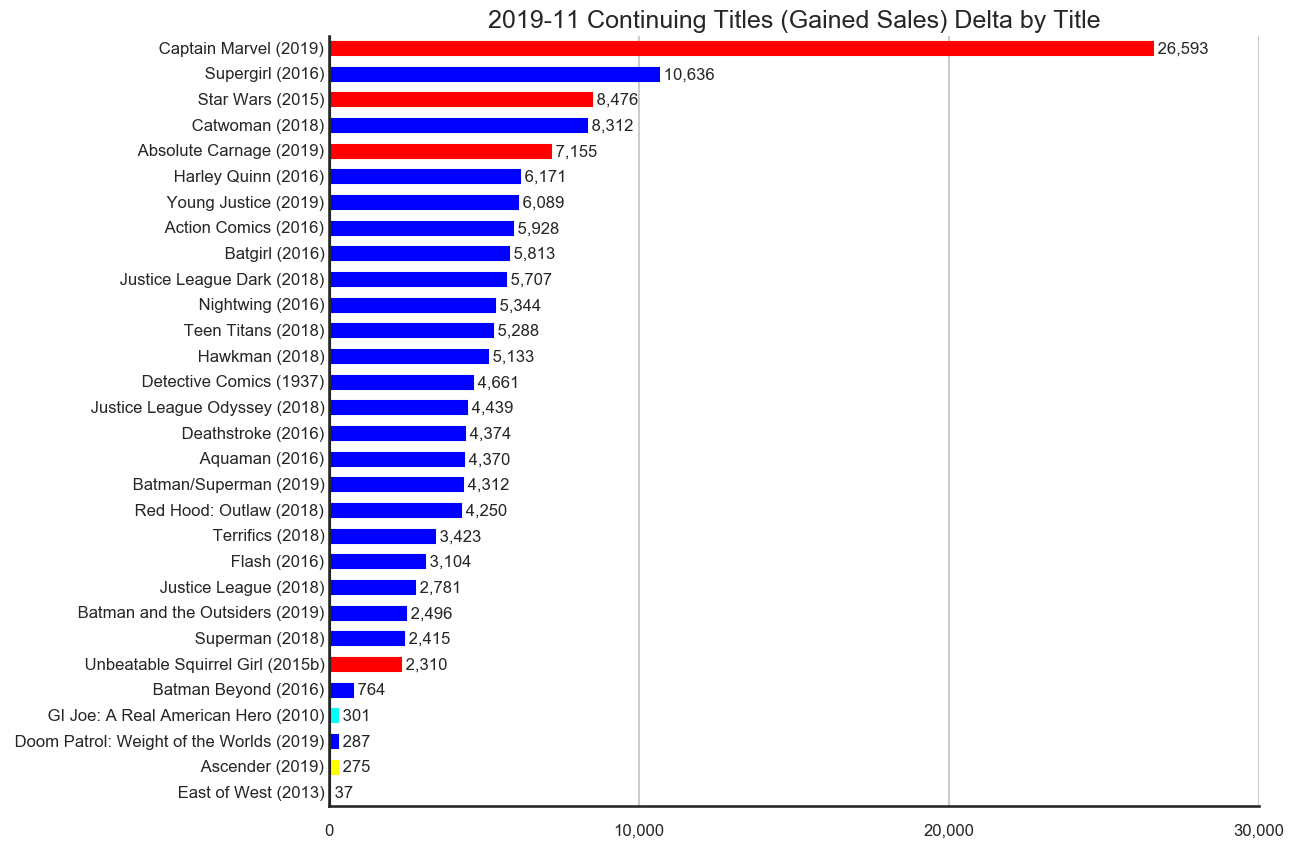

The 30 titles across the 4 publishers in the continuing titles which gained sales category accounted for 1,136,428 units in the top 300 comics with an upswing of 151,244 units.

DC Comics accounted for 70.15% of the change in this category but Captain Marvel from Marvel was the title with the largest gain in this category with 26,593 more units for the title this month over last month.

Some of the DC titles had issues with an acetate cover which seems to have contributed to the increase in sales. Other titles like Batman/Superman had the card stock cover this month but not last month which seems to have contributed to the sales increase. The different types of covers like the card stock cover and the acetate covers and the different price points for them and the changing use of them from issue to issue seems to generally be working for DC. This is evidence of a segment of the market which is interested in these cover gimmicks and that segment is large enough to materially impact sales. As a result, since the tactic is working, it is very likely to continue.

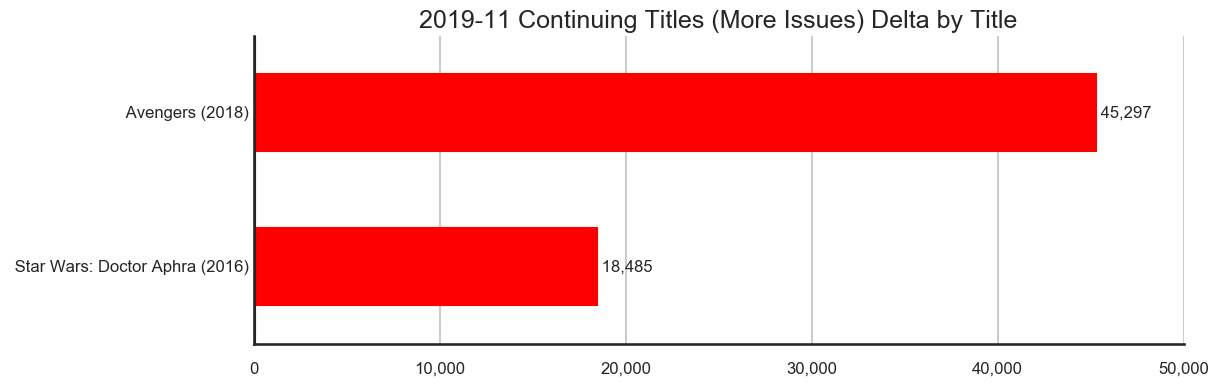

There were only two titles from Marvel in the continuing titles which shipped more issues category accounted for 131,813 units in the top 300 comics with an upswing of 63,782 units.

Avengers dropped in sales by 5,714 units on the first issue of the month and then increased in sales by 8,934 units on the second of the month for a net increase of 3,220 units per issue for the month. The total increase of 45,297 units for the title reflects both the net increase per issue and the sales of a second issue versus just a single issue last month.

Both issues of Star Wars: Doctor Aphra dropped in sales. The first issue dropped by 724 units and the second dropped by 307 units. These drops of 3.58% and 1.57% respectively at within the bounds of standard attrition. The net increase for the title reflects two issues shipped this month versus the single issue last month.

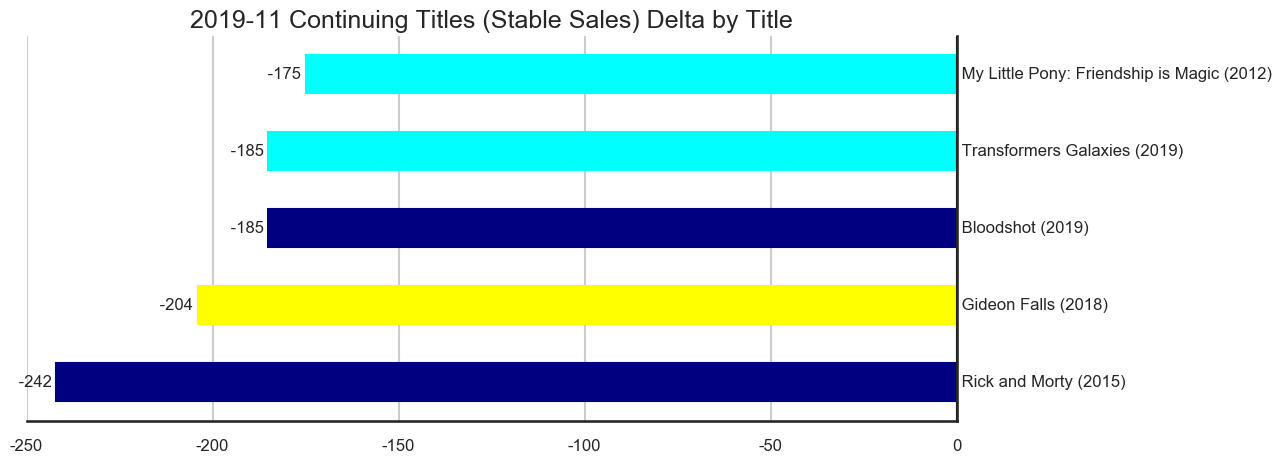

The 5 titles across the 4 publishers in the continuing titles with reasonably stable sales category accounted for 43,410 units in the top 300 comics with a downswing of 991 units.

This data really underscores the need for me to find the time to rework my number crunching process. The original idea of this category was to show titles which had an reasonably insignificant drop in sales. The mistake I made was to use the number of units instead of a percentage drop as the criteria. The current criteria of a drop of 250 units or less is a tiny drop in the bucket for the overall sales of the month. A better category would be continuing titles with standard attrition with a criteria of a drop of some percentage, say maybe 4%, of less. All of these titles would still fit within this category but so would nearly another dozen titles like Conan the Barbarian and Savage Sword of Conan.

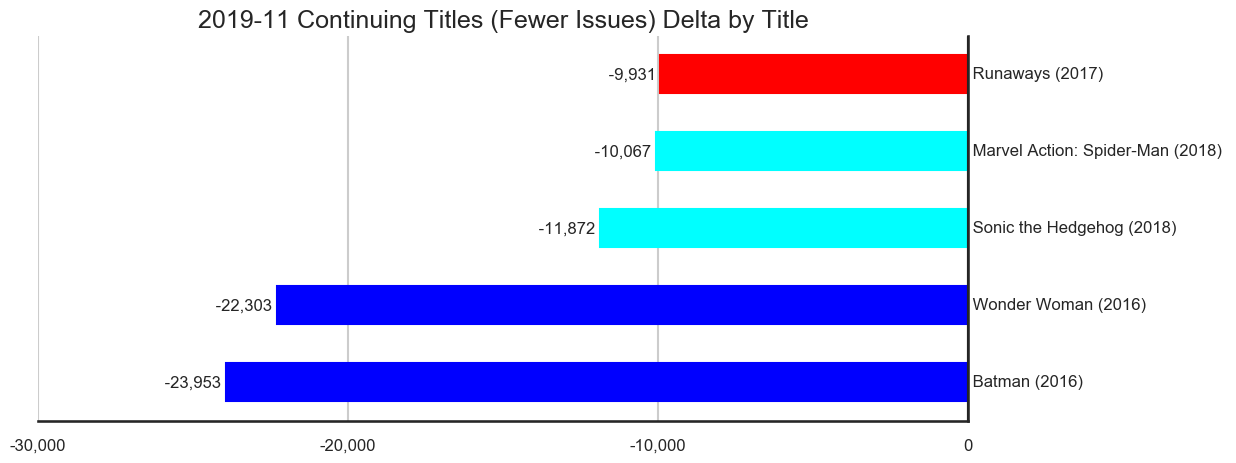

The 5 titles across the 3 publishers in the continuing titles which shipped fewer issues category accounted for 233,133 units in the top 300 comics with a downswing of 78,126 units.

Wonder Woman #82 was up in sales by 20.23% thanks at least in part to the acetate cover. The drop of 22,303 units for the title reflects the aggregate sales of the title from month tot month with only a single released this month versus the two released last month.

The drop of 23,953 units for the Batman title this month reflects three issues releases last month, one of which was a facsimile edition, versus the two issues released this month. The title was actually only down by around 2,693 units but between the multiple line items for the different issues at the different prices and the facsimile edition which is in the incoming data the same way a variant cover appears, my number crunching system got confused. Clearly I need to improve how my system handles different line items for the same issues at different price points and how it identifies and handles facsimile editions.

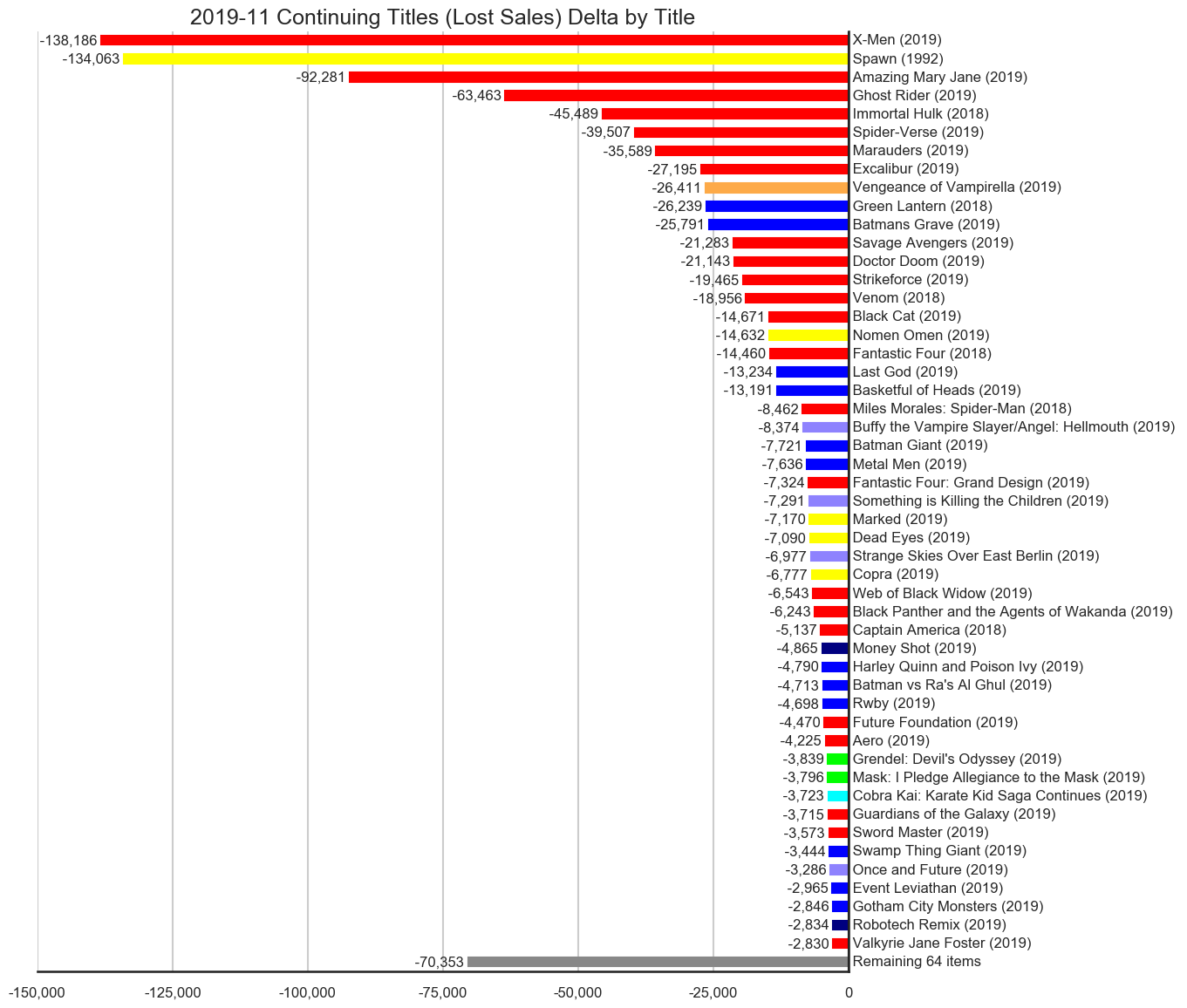

The 114 titles across the 12 publishers in the continuing titles which lost sales category accounted for 2,278,882 units in the top 300 comics with a downswing of 1,032,959 units.

Marvel Comics accounted for 61.15% of the change in this category. Massive second issue drops happened on X-Men, Ghost Rider, Spider-Verse and Amazing Mary Jane.

Spawn #302 dropped by 137,059 units to 51,968 units after the hoopla around the 300th and 301st issues of the title. The drop of 72.51%, while massive, is neither surprising nor quite as large as I was expecting. The sales of 51,698 units are not as high as the sales were on the two issues leading up to Spawn #300 but are well over twice what the title was selling this time last year and the highest the title has seen in sages if you exclude Spawn #200, #250 and #298-301 the title has never sold this high while Diamond has been reporting final sales which started in February 2003. We'll see if the title sees a long term benefit from the interest generated around milestone issue #300.

Continuing the point made when discussing the continuing titles with reasonably stable sales category, the continuing titles which lost sales category usually has the most titles in it. I'm debating if it makes sense to replace the continuing titles with reasonably stable sales and this category of continuing titles which lost sales with three new categories. The first category would probably be continuing titles with standard attrition with the criteria being a drop of some percentage, say 4%, or less for the title for the month. The next category would be drops of between that percentage and another percentage, say maybe 50%, for the titles which had a larger drop than can be accounted for by standard attrition but not a massive drop in sales. The third category would be the titles with those massive drops over that percentage. The idea is there is a significant difference between the slow decline in sales which is common place, the larger decreases in sales which happen and the massive drops in sales on things like second issues or after a major promotion push on the preceding issue. If you have thoughts on how I can make these categories more meaningful, please email me at John.Mayo@ComicBookResources.com with your thoughts.

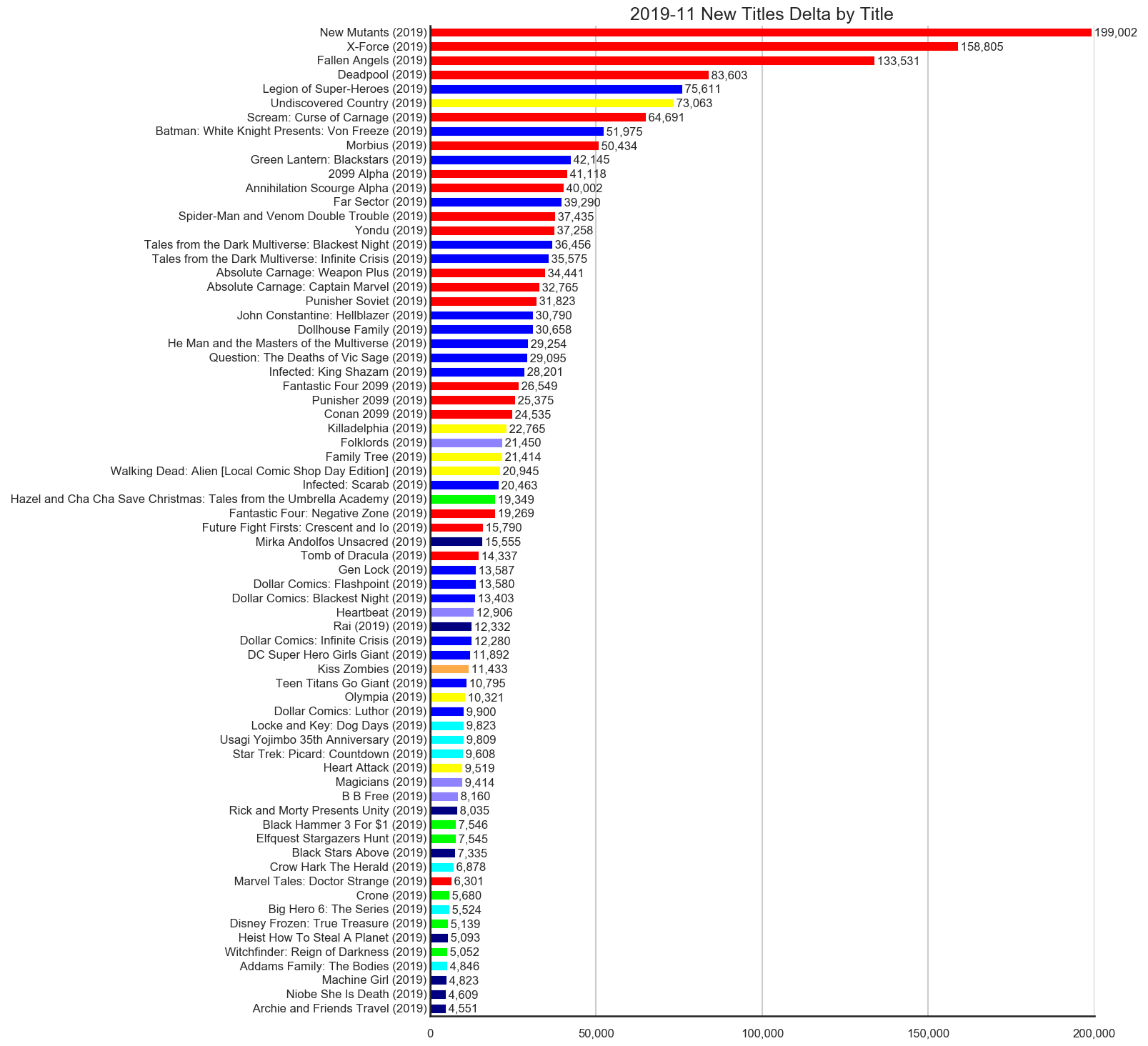

The 48 titles across the 14 publishers in the new titles category accounted for 1,472,852 units in the top 300 comics with an upswing of 1,472,852 units.

Marvel Comics accounted for 54.08% of the change in this category. Additional Dawn of X titles launched with New Mutants, X-Force and Fallen Angels having exceptionally strong first issue sales. The first three Dawn of X had an average second issue drop of about 45%. If that happens on the three titles launched this month, New Mutants #2 would come in around 109,451 units, X-Force #2 would land around 87,343 units and Fallen Angels would sell around 73,442 units. Obviously the second issue drops on the first three titles are not a solid predictor of what the second issue drop on the other three titles will actually be next month.

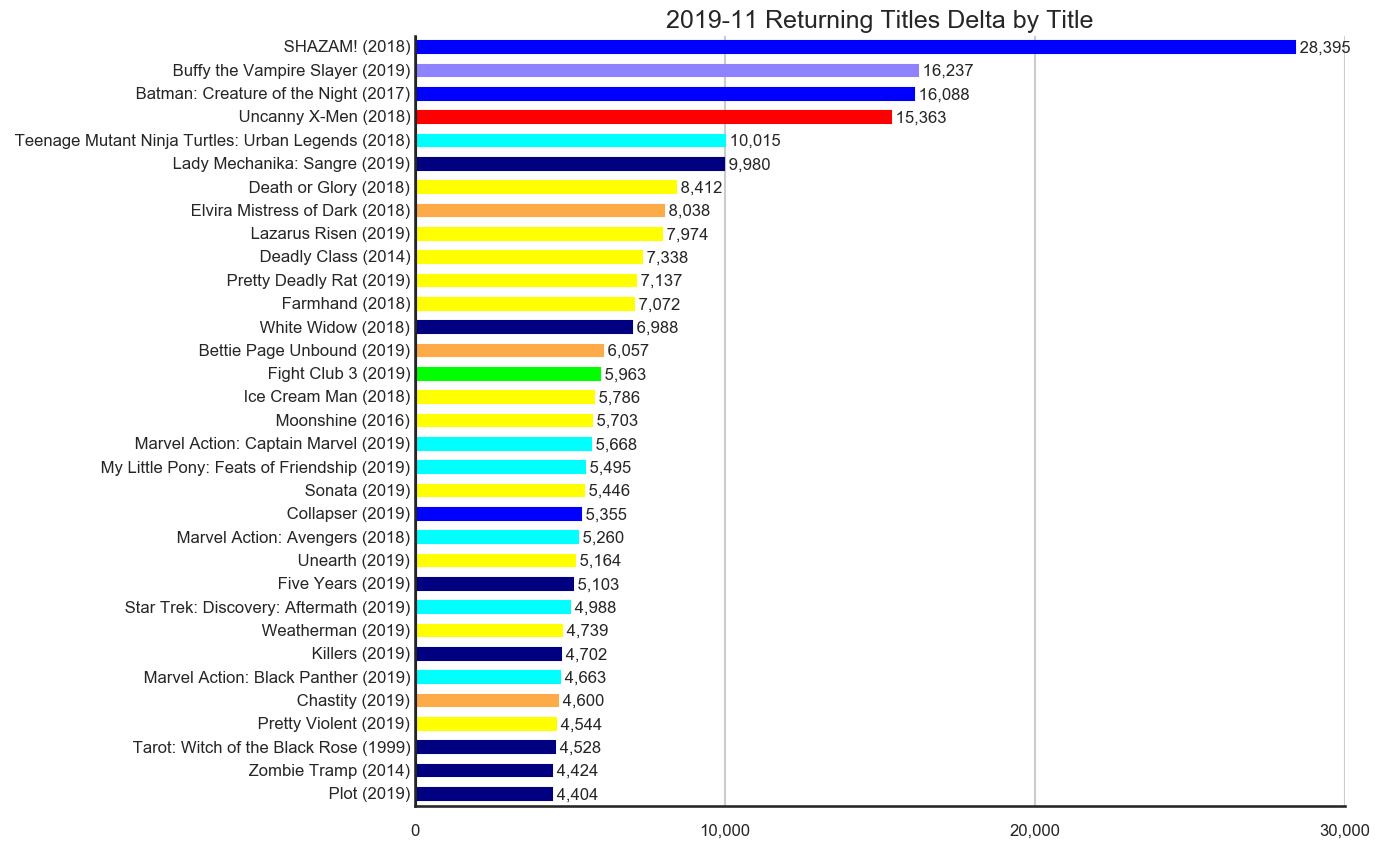

The 33 titles across the 14 publishers in the returning titles category accounted for 251,629 units in the top 300 comics with an upswing of 251,629 units.

SHAZAM! was the most notable returning title this month but Batman: Creature of the Night was the longest delayed title with a 84 week gap between the third and final issues. Moonshine and Death or Glory also had gaps over over a year between issues. That is not to say the issues were late. Late being defined as shipping after the expected shipping date of the issue, not the gap of time between issues.

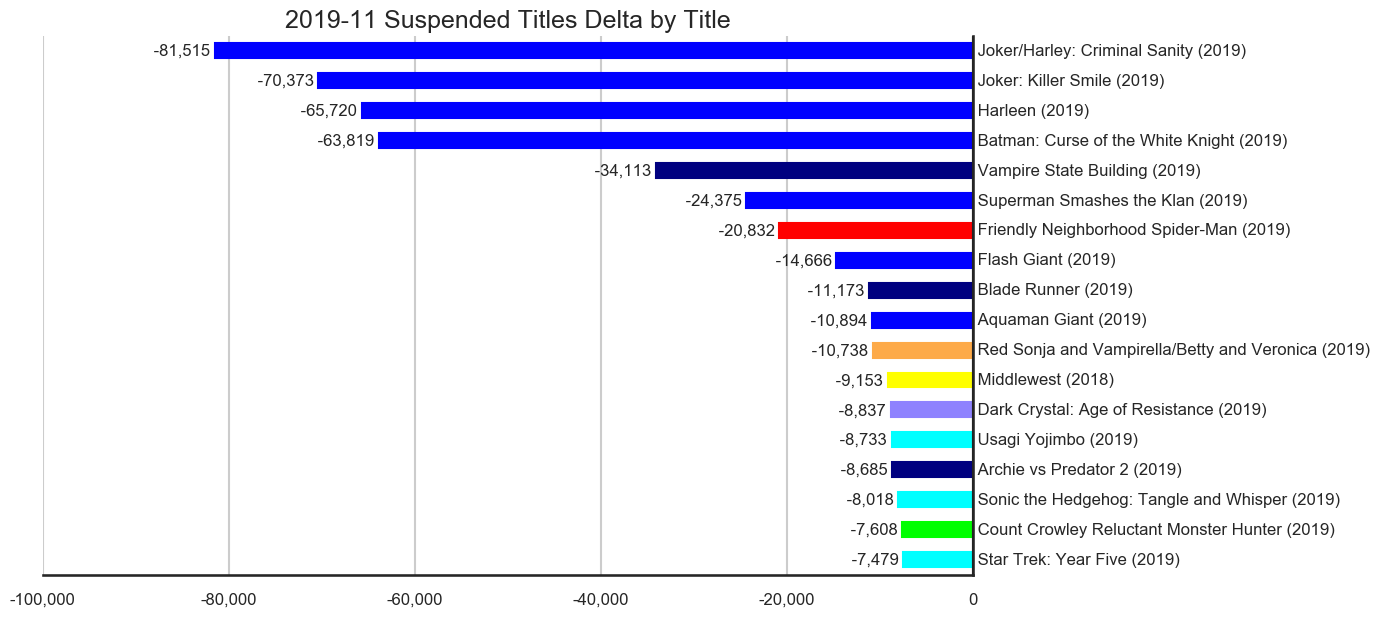

The 18 titles across the 10 publishers in the suspended titles category had a downswing of 466,731 units. DC Comics accounted for 71.00% of the change in this category with various Batman family properties topping the list.

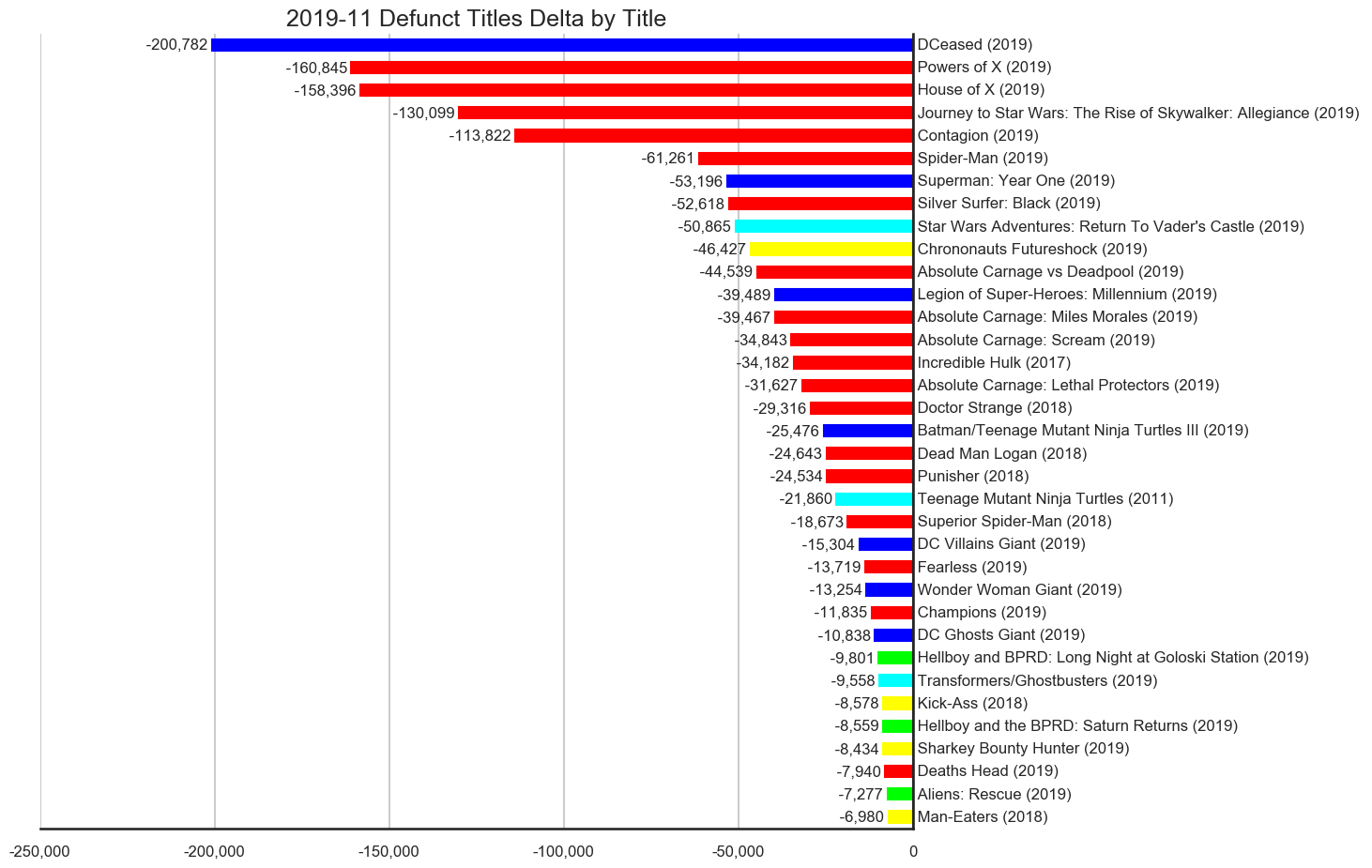

The 35 titles across the 5 publishers in the defunct titles category accounted for 0 units in the top 300 comics with a downswing of 1,529,037 units. Marvel Comics accounted for 64.90% of the change in this category much of which was due to the end of House of X and Powers of X last month and the end of numerous Absolute Carnage titles. DCeased was the most notable DC title in this category. That success of that series is resulting in the DCeased: Unkillables limited series which should launch near the end of February.

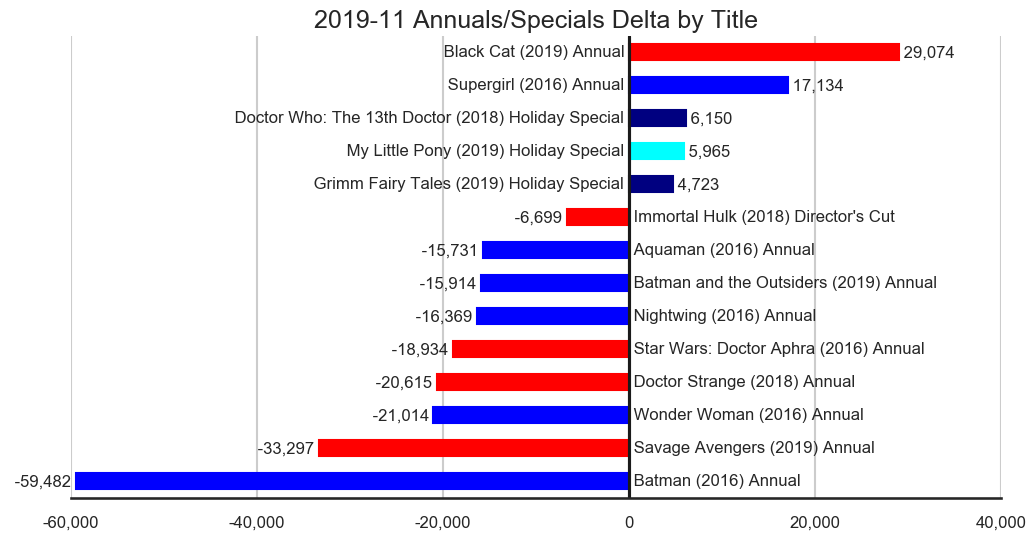

The 15 titles across the 5 publishers in the annuals/specials category accounted for 63,046 units in the top 300 comics with an upswing of 63,046 units, a downswing of 233,291 units for a net a decrease of 170,245 units. DC had most of the downswing in this category with 61.77% of it while Marvel had most of the largest upswing with 34.81% of it but that is as much of a reflection of when various annuals and specials are released as anything else.

The 55 titles across the 4 publishers in the non-series category accounted for 519,684 units in the top 300 comics with an upswing of 519,684 units, a downswing of 962,762 units for a net a decrease of 443,078 units. Marvel had most of the activity in this category with 65.59% of the upswing and 53.97% of the downswing.

DC is getting more active in this category with the Tales from the Dark Multiverse and the Dollar Comics one-shots.

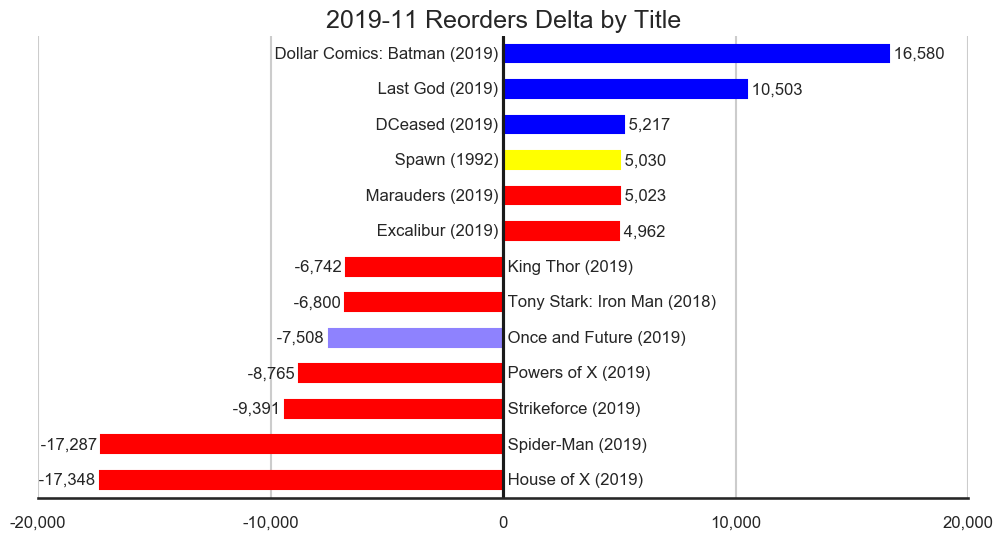

The 13 titles across the 4 publishers in the reorders category accounted for 47,315 units in the top 300 comics with an upswing of 47,315 units, a downswing of 73,841 units for a net a decrease of 26,526 units. DC has 68.27% of the upswing while Marvel had 89.93% of the downswing. There simply wasn't as much reorder activity this month. The most notable reorder activity was on Marauders #1 and Excalibur #1. Even thought the sales of the second issues of both titles were down, reorders on the first issues is still a good sign.

It is worth taking a closer look at the unit sales and deltas for the title status categories given the large decrease in sales for the top 300 this month.

The core of the unit sales was the continuing titles which lost sales. Titles in this category averages sales of 19,990 units with an average drop of around 9,061 units for the month. It isn't surprising given most titles drop in sales over time. Standard attrition of even just a few percent adds up when it impacts over a third of the titles in the top 300. This month there were 114 titles in this group. This category acts as an unstable foundation for long term sales. Preventing or even just reducing the loss in sales for titles from month to month could go a long way in increasing over all sales.

The next largest block of units this month was new titles. Titles in this category averages sales of 30,684 units all of which are new units to the top 300 comics list by definition. This group was the largest increase in sales for the month. This reliance on new titles for unit sales also illustrates the problem in sales retention on existing titles. If the existing titles could maintain sales better, there would be less need for publishers to create as many new titles as they currently do. Not only did this group provided the second most units but it also had the second most number of titles in it with 70 titles.

While there is a very real need to get new readers and to create new titles and properties, there is a greater need to work on retaining sales on existing titles. It is much easier to get readers and retailers to sample a new title and much harder to get them to keep getting everything they have been getting. The importance of understanding how and why ongoing title lose sales is part of what is motivating me to rethink the continuing titles with reasonably stable sales and continuing titles which lost sales categories and replacing them with categories which might provide more insight.

For a more in-depth discussion of the sales data, check out the Mayo Report episodes of the Comic Book Page podcast at www.ComicBookPage.com. The episode archived cover the past decade of comic book sales on a monthly basis with yearly recap episodes. In addition to those episodes on the sales data, every Monday is a Weekly Comics Spotlight episode featuring a comic by DC, a comic by Marvel and a comic by some other publisher. I read around 200 new comics a month so the podcast covers a wide variety of the comics currently published. If you are looking for more or different comics to read, check out the latest Previews Spotlight episode featuring clips from various comic book fans talking about the comics they love. With thousands of comics in Previews every month, Previews Spotlight episodes are a great way to find out about new comic book titles that may have flown under your comic book radar.

As always, if you have any questions or comments, please feel free to email me at John.Mayo@ComicBookResources.com.