Mayo Report for 2012-06

|

|

Top Comics List Top Comics Breakdown Top Trades List Top Trades Breakdown

The June 2012 numbers were released during Comic-Con International: San Diego 2012 which always makes for an interesting counter-point to the sales data. While Comic-Con is still very heavily a comic book convention, it has grown into much more than that. I've been going to Comic-Con every year for about the last 30 years. I've seen it grow from a small regional convention to the comic book mecca that it is today. During that same time, comic books and the super-hero genre has achieved general acceptance. With more than 125,000 attendees, Comic-Con has a bigger audience than all but the top selling comics. In June 2012, only "Avengers vs X-Men" #6 and #5, "Batman" #10 and "Justice League" #10 sold over 125,000 units to retailers. To say there are more potential readers out there than most comics are reaching is an understatement.

An estimated total of 7,033,386 combined units were sold by the top 300 comics in June 2012, down around 261,700 units from May 2012 but up over a million units from June of 2011. On average, each item on the list sold around 23,445 units. The midpoint of the list sold around 14,290 units meaning most title on the list sold below average. Depending on how you look at the data, sales are booming, tanking or somewhere in between. It all depends on your perspective. Personally, I think sales are doing fine but could be better.

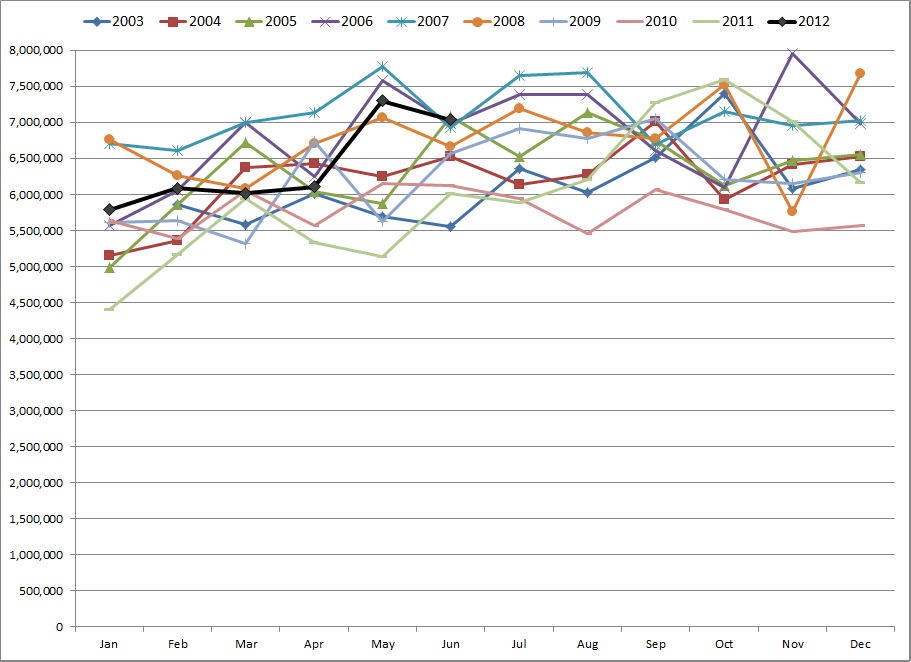

The final order era which stared in early 2003 when Diamond shifted from releasing data based on pre-orders placed by retailers to reporting what was actually shipped and invoiced to retailers each month. During that time, the top 300 comics have averaged around 6,380,000 units a month with a low of around 4,400,000 units in January 2011 and a high of around 7,960,000 units in November 2006. Here are charts of the total sales for the top 300 comics during the final order era both historically and on a year by year basis:

As can be seen by these charts, sales right now are fine. They are neither the best they have ever been nor are they the worst. One positive sign is the 12 month rolling average is on the rise and the highest it has been since early 2009.

What is has changed over time that isn't apparent from these charts is how much of those sales are being supported by solid stories and genuine interest in the content and how much is of a more speculative nature due to variant covers, events and other sales gimmicks. There are many ways to get readers to buy a comic. Some methods result in long term readers while others don't.

DC had a clear sales success with all four of the Before Watchmen titles released in June selling over 100,000 units. While some of these stories could have been told with renamed characters in different costumes, the result would have been drastically lower sales. So while people might debate the pros and cons of DC telling more stories in the Watchmen universe, from a sales perspective it was a good move. While fans might be conflicted on this, there was a lot of curiosity about it too. Even if sales drop on these titles going forward, DC will have some companion trade paperbacks to go along with the "Watchmen" trade paperback which was in third place on the top trades list with an estimated 11,372 units of reorder activity. The sales of the final issue of these miniseries will be more indicative of what the reader interest actually was. If the collected editions come anywhere close to the evergreen status of the "Watchmen" trade paperback that too will financially justify the decision to do Before Watchmen.

Over at Marvel, while "Avengers vs X-Men" took the top two slots again in June, the companion titles of "AvX Vs" is selling about half as well as the main mini-series. What is particularly interesting is the top selling ongoing X-Men title was "Astonishing X-Men" #51 with approximately 82,650 units. That issue featured the wedding of Northstar was not part of the "Avengers vs X-Men" event. The top selling ongoing Avengers or X-Men title that was part of the event was "Uncanny X-Men" #13 which sold around 70,523 units which is roughly 37% of the sales of "Avengers vs X-Men" #6. While the event itself is doing very well and has gained sales with each issue since the third, it is failing to bump up the sales of the related titles. This might lead to more self-contained event titles from Marvel in the future.

One of the outcomes of the "Avengers vs X-Men" event is the Marvel Now relaunch of a variety of titles at Marvel. While first issues generally sell better than any other issue for a title, relaunches are a gamble for the publishers. Ending a title or even just a volume of a title and either launching a replacement title or simply relaunching the title with a new first issue give readers both a jumping off point and a jumping on point. With few ongoing Marvel titles selling over 50,000 units, odds are the relaunch will be beneficial for Marvel, at least initially. Eventually the sales on most of the relaunched titles will drift down to around how they most of the current titles are selling now.

Just as we've seen the sales power of the event diminish from the doubling and tripling of sales of tie-in issues during "Civil War" to the modest bumps for "Avengers vs X-Men," each time a publisher relaunches a title, the power of that new first issue diminishes. Not only has the power of the first issue diminished, the drops on some second issues are staggering. "G. I. Combat" #2 from DC dropped around 43.67% from the first issue. Given it is an anthology title such a drop isn't too surprising. DC probably would have been better off having the title feature either "The War That Time Forgot" or the new "Unknown Soldier" but not both at the same time. "X-O Manowar" #2 dropped to a little under half the sales of the first issue of that series. The drop here was most likely caused by sales of the first issue being inflated by multiple cover gimmicks.

Of course, the reason the publishers keep doing these things is because they work. "Thunderbolts" #174 sold around 18,791 units in May. The following issue of the renamed series was "Dark Avengers" #175 which sold 39,534 units in June. This essentially put the series back into a "honeymoon period" with that issue acting like a first issue. As should be expected, the next issue typically drops and, sure enough, "Dark Avengers" #176 dropped by around 12.46% down to around 34,610 units. The drop was less severe than a second issue drop usually is since many of the readers weren't actually new readers but continued with the title through the renaming.

Another sales gimmick which won't go away any time soon is the variant covers Nearly a third of the items in the top 300 had alternate, variant and/or incentive covers. Some items had half a dozen or more covers. At one point, Marvel was able to bump sales by 5,000 to 7,000 units with things like the zombie variant covers. With so many issues having so many covers, it is much harder now to isolate the bump caused by variant covers. The future of this sales tactic may be determined by the digital sales. In that arena, alternate covers might cause confusion and a backlash with customers. Collectability is not a factor with digital comics. Print sales gained through variant covers are the pinnacle of short-term sales. Often these covers are bought by existing readers who are double-dipping and are not a reflection of any real increase in readers. The long term future of a title is ultimately determined by how many loyal regular readers it has.