Mayo Report for 2011-05

|

|

|

Top Comics List Top Comics Breakdown Top Trades List Top Trades Breakdown

May 2011 was another month of lackluster sales. Nothing cracked 100,000 units and only a handful of comics even came close. "Fear Itself" #2 moved an estimated 96,318 units into retail stores during the month. "Flashpoint" #1 only moved about 86,981 units. Those titles are the core of the major summer event storylines for Marvel and DC respectively. In the past, not only have these event titles topped the charts but have sometimes done so by a very wide margin. It was not unusual for the top selling comic to be double the sales of the next bestselling comic.

"Fear Itself" centers around Thor, Captain American and Iron Man and involves nearly every major character currently active in the Marvel Universe from the Avengers to the X-Men. It even includes a number of inactive characters like the Frankenstein monster and Howard the Duck. For this series to drop below 100,000 units with the second issue is a bit surprising. This is the lowest sales of any of the Marvel events over the past few years.

"Siege" is included in the chart for comparison purposes but was not a full-fledged event title since that storyline didn't involve the majority of the Marvel Universe properties. Crossover storylines which tie together only a handful of titles usually sell only a little higher than the highest of those titles. Frequently the target readers of these smaller scoped storylines already read the majority of the titles involved. Major event titles are able to draw on the audience of all of the connected titles. The larger the group of titles is, the more unique readers there are and the higher the potential sales of the crossover. Since "Fear Itself" spans the entire Marvel Universe, the majority of the readers of titles set in the mainstream Marvel Universe should be interested in it. Based on the sales of the second issue, that doesn't seem to be the case. If the sales for "Fear Itself" continue to decline, don't be surprised if Marvel decrees it is time for them to focus on individual titles instead of line-wide events for a while. Part of why "Civil War" was so successful was because it had been years since Marvel had done a line-wide event. Over the past couple of years, major events have been happening at both DC and Marvel on a routine basis. This is a great way to prop up sales but it does not build long term sales. When the event ends, so does the sales bump.

"Flashpoint" started up in May and kicked into high gear in June. The main obstacle this event had to overcome was the way it was marketed. The solicitations were information poor and written in a haiku like format: "His power is his curse!" How does that get potential readers interested in a new and unknown character? It doesn't. For this event, the solicitation blurbs were the curse. The other obstacle "Flashpoint" faced was too many concurrent miniseries. In addition to "Flashpoint" and "Booster Gold," there were 16 miniseries and four one-shots solicited in the first month. Faced with so many decisions and so little information to base them on, instead of deciding on a case-by-case basis, many people may have adopted a simple heuristic: don't get most of them. The June sales information will reveal how well those titles did. No doubt some will do very well but a few are likely to be near the bottom of the list of DC Universe items for June.

Since the first issue sales are the high water mark for a title in the typical sales trend, maximizing the first issue sales is exceedingly important. To a lesser degree, every issue of an ongoing title is a decision point with inertia acting in favor of continued sales. Based on the sales trends, something is working against the story momentum resulting in most titles losing a few percent of the sales with every issue. At an aggregate level, this downward trend is usually masked by the influx of sales of newer titles at the top of the chart. This is how sales can be down on most titles while the monthly total looks deceptively healthier. This year, however, the top of the chart has been weaker the normal. In May, the estimated sales of "Amazing Spider-Man" #661 were around 59,087 units. Even with sales below 60,000 units, it still landed in the top 10 for the month. With both DC and Marvel running major events and all of the top ten items having multiple covers, only the top five items had estimated sales over 61,000 units. There have been months in which sales that low wouldn't have made in the top 30 items. In August 2006, those sales wouldn't have cracked the top 40.

The abundance of "Flashpoint" miniseries and one-shots and the upcoming relaunch of the DC Universe in September brings up the idea of decision points. Each new title is a decision point for readers and retailers. Should they get the new title or pass on it? Each decision point presented to a reader or retailer force them to either look at the item and decide if they want to get it or to not bother with the hassle and skip it. Obviously not every item will appeal to every reader. In that respect, more options are a good thing. Many new titles are not all that different from other available options and might only be confusing the decision making process. One factor that may be decreasing sales is this paradox of choice introduced by having so many similar titles. Having two Batman titles to pick from is an option, having five or more can become a dilemma. More options increase the chances of decision paralysis resulting in lost sales.

DC is addressed this decision point quandary for the new line up of titles by providing information about them earlier than usual. The roll out of a handful of titles each day gave readers and retailers a chance to absorb the information in digestible chunks before the other companies released their solicitations for September.

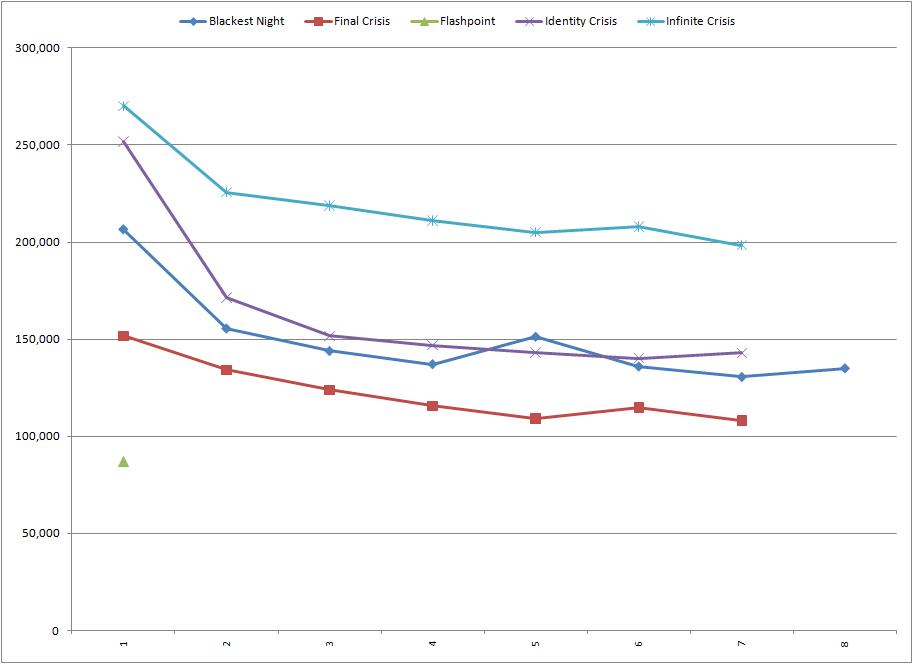

This relaunch of the DC Universe titles is not entirely unprecedented. While "Crisis on Infinite Earths" and "Zero Hour" both introduced some major changes in the DC Universe status quo, the One Year Later initiative coming out of "Infinite Crisis" in May 2005. One Year Later was not an event or story arc but a marketing/editorial initiative to shake things up in the DC Universe. The titles all moved forward a year of narrative time with changes to the characters and creative teams on existing titles and some titles changing names and lead characters. Sales shot up for DC in May 2005 by around a million units from the previous month as a result of this move:

Unsurprisingly, while readers sampled most of the revamped titles at the start of One Year Later, not all readers stayed with all of the titles. Within about six issues, the massive sales gain had already been washed away. The takeaway is getting readers to sample a title only had a long term benefit if they stick with the title. The sales in December and January will show if DC is more successful in this respect this time around.

This DC relaunch includes day and date digital releases of all of the titles. I'd love to include an analysis of the digital sales but I currently don't have access to that data. With this line-wide digital availability of all of the titles in the main product line of one of the major publishers, the comic book industry is clearly entering the digital age, if it hadn't already done so. This digital sales channel is unlikely to operate along the same trends as the physical sales channel for comic books. With comic books, readers typically pick up each week everything that came out that they are interested in. With digital comics, there is no incentive to get the new digital issues the day they are released. With the price dropping on the DC titles after a month, there is a disincentive to getting the issues quickly. From a strictly pragmatic point of view, there is no reason to buy a digital comic book until you are ready to read it. This mirrors the sales trends we see on the trade paperback sales charts a lot more than it does the comic book sales charts. The sales in that area are significantly lower but on selected titles, infinitely longer.

Digital comics allow for the Long Tail effect to come into play. The near zero cost of having the issue available means it can be on the digital shelf of the online retailer and sell slow and steady and still be profitable and viable, at least, on a per issue basis. Once an issue is released digitally, it can start making money, if not profit, immediately and continue to do so forever. If the initial sales aren't enough, whatever that benchmark might be, then the title might not continue. We see this already today with titles that do okay on collected editions but not well enough on the monthly issues and collected editions in the short term to keep the title going. This phenomenon of titles being canceled as they become sleeper hits could become much more pronounced in the digital age.

Some of the new DC titles strike me as likely to be very successful while a few seem likely to have a harder time finding an audience in the current marketplace. DC is taking a chance with a number of titles and trying to do something different. Some of those attempts aren't going to work. Hopefully a few will and we'll get something great out of it. Despite the Batman family of titles still being large, DC has a diverse line up of titles planned. Properties which had migrated to Vertigo are coming back home into the DC Universe. The western, super-natural and war genres are represented. The total number of DC Universe titles is manageable with only a baker's dozen titles being released each week. The question is if DC can raise the average sales for the DC Universe titles which have leveled off around 30,000 units.

The low average sales in January 2005 happened right after Identity Crisis ended because it and a few other top selling titles didn't ship that month. The high point in August 2005 was the start of "Justice League of America" and the first issues of "52" which were not adjusted down 20% to account for possible returns. Lifting the average sales of the DC Universe titles should be one of the goals on this relaunch. A couple of top selling titles is great but the entire DC Universe line of titles needs to be selling better than it has been.

My expectation is DC will see a major increase in sales in September 2011 with this relaunch. This increase could be as much as a million unit gain over August. Sales in October will appear to drop heavily compared to September with many titles possibly dropping around 40% or more. The drop off in November will likely be closer to another 10% to 20% on most titles. The December sales will be the first to reflect the reader reception of the actual contents of the new DC Universe. We could see a number of titles jump up at this point depending on both the perceived quality of the material and how much reorder activity there happens in October and November. January 2012 is going to be the real test of the new line up since January is typically a very weak month. By that point, the new-ness will have worn off and the fate of the titles will start to become apparent. Of course, all of that could change drastically depending what else DC has in store for the rest of the year.

Personally, I'm excited about the new DC 2.0 relaunch. Based on the sales trends, this sort of bold move makes sense. If it includes a major effort on the creative teams and editors at DC to make and keep the DC Universe as accessible and inviting to new readers as possible, this could be exactly what the industry needs.